In the world of retail pricing, decisions are only as good as the data behind them.

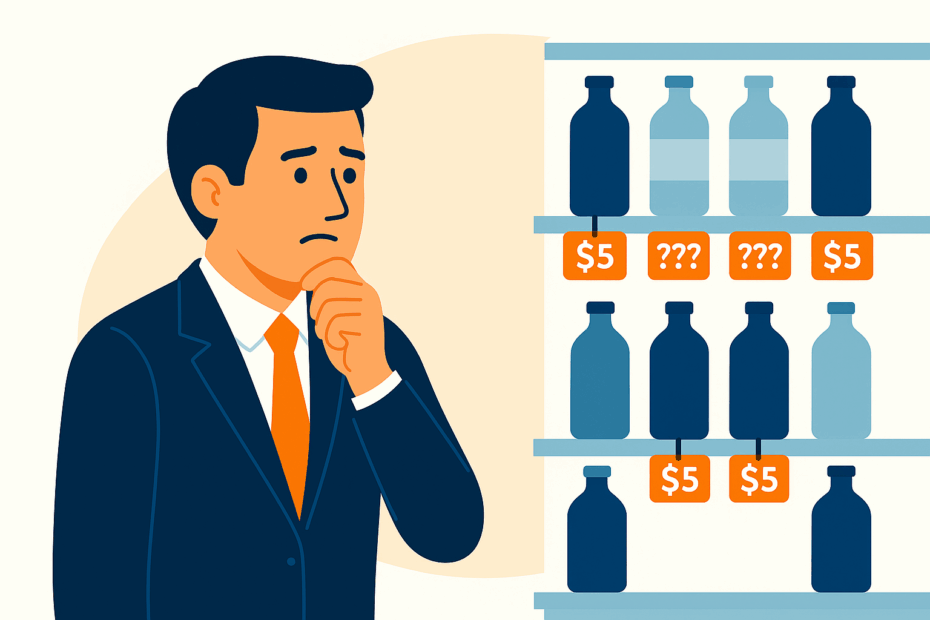

But even the most advanced pricing systems can miss things, creating pricing data gaps that quietly erode margin, market share, and team confidence.

At InsiteTrack, we believe data confidence goes beyond dashboards and daily updates. It’s about knowing your pricing decisions are built on complete, relevant, and trusted intelligence — especially when it matters most.

Let’s look at what happens when pricing data gaps go unnoticed, and how to fix them before they cost you more than you realise.

Where Pricing Platforms Often Fall Short

Not all price intelligence solutions are built equally. Many offer automated updates and competitor scraping, but they can struggle when things go off-script — especially in dynamic retail environments.

Here are common pricing data gaps we see regularly:

Promotional activity not captured – A competitor may display a standard price, but a basket-level discount, voucher, or temporary markdown is missed. This creates an illusion of price parity when you’re actually being undercut.

Missing competitor SKUs – Without expert product matching, high-impact products can be left untracked, skewing your market view.

Outdated competitor snapshots – Delayed or infrequent updates mean you’re reacting to yesterday’s market, not today’s.

Stock availability blind spots – You might think a competitor is undercutting you, but if they’re out of stock, you’re unnecessarily giving away margin.

Channel inconsistency – Many retailers treat marketplaces, DTC sites, and in-store pricing separately. When platforms do the same, strategy alignment suffers.

The Real Cost of Incomplete Pricing Data

Individually, these gaps may seem small. Together, they have serious commercial consequences:

Lost margin from unnecessary price matching

Missed opportunities to lead pricing when competitors are weak

Inefficient promo planning without proper market context

Declining trust in pricing data and recommendations internally

Slower decision-making as teams verify or redo work

When pricing data gaps exist, strategies become reactive instead of proactive — and reactive pricing doesn’t scale.

How Ad-Hoc Data Can Fill the Gaps

Even the most advanced automated pricing systems can’t cover every scenario, every time.

That’s why flexible, ad-hoc data support can be a game-changer for pricing teams.

At InsiteTrack, our clients often request one-off reports, custom snapshots, or deep-dives outside of their standard feed — and we deliver quickly.

Examples include:

Flash competitor scans during peak trading

Category-specific promo tracking ahead of launches

Rapid stock-out audits across key rivals

One-time alignment checks across channels or regions

This flexible approach helps pricing teams close pricing data gaps fast, maintaining confidence when the pressure is on.

Building True Data Confidence

You shouldn’t have to second-guess your pricing data. And your team shouldn’t be forced to choose between speed and certainty.

True data confidence means:

You trust your daily data feed

You know what’s being tracked and why

You have coverage in the most critical areas

You can get answers quickly when gaps appear

Your solution partner evolves alongside your strategy

At InsiteTrack, we combine reliable automation with responsive, expert-led service to give our customers a complete view of their market — not just the easy-to-track parts.

Gaps Are Expensive, Certainty Pays

Blind spots in your pricing data are like leaks in a ship — easy to miss at first, but over time, they slow you down and sink performance.

By partnering with a provider that combines robust automation with the flexibility to close pricing data gaps, you make stronger, faster, and more profitable pricing decisions.

Because confidence in your data isn’t just reassuring — it’s a competitive advantage.

Do You Have Ad Hoc Data Requirements?

Got an urgent pricing question? We deliver the ad-hoc data you need, when you need it.